We’re all in this together (especially the poor)

Article published: Tuesday, September 14th 2010

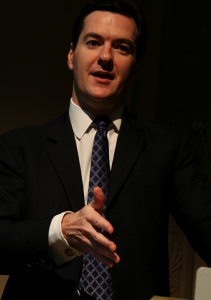

Gideon “George” Osborne’s budget has certainly been tough but, asks Tom Fox, is it fair?

Gideon “George” Osborne’s budget has certainly been tough but, asks Tom Fox, is it fair?

Despite its rhetoric about fairness and compassion, the coalition’s raising of VAT from 17.5 per cent to 20 per cent is a regressive policy that will effect the poor far more than the rich. By definition, progressive taxes are direct ones which, like income tax, decrease inequality by targeting those who can afford to pay. Indirect taxes like VAT, in the words of the Office of National Statistics, “have the opposite effect to direct taxes, taking a higher proportion of income from those with lower incomes…they are regressive.” Simply put, the VAT rise means the poorest will have to adjust their personal budgets while the rich are barely troubled.

Research by Save the Children shows that, while the richest 10 per cent of the population will spend 7 per cent of their income on VAT, the poorest will loose 13.7 per cent. Another study, co-authored by economists and the Fabian Society, calculates this figure to be as high as 21.7 per cent when public spending cuts are taking into account. VAT also affects certain groups disproportionately: the disabled, who often have to buy expensive equipment or pay care and treatment bills, and the unemployed, elderly, and students, who all pay higher taxes on lower, or non-existent, incomes.

Targeting Manchester

All of this is bad news for Manchester, where, as with the country as a whole, there is an increasing income gap between rich and poor. In 2006, the average weekly salary in Tatton and Altrincham & Sale West, the two parliamentary constituencies in the region with the highest wages, increased by 22.9 and 11.8 per cent respectively. At the same time, wages fell in the three worst paid areas. Ashton-under-Lyne saw a 2 per cent reduction, Denton and Reddish 3.5 per cent, and Gorton 6 per cent.

Similarly, recent figures show a wage gulf between those living in Manchester and those commuting in to work in the city. Manchester’s average wage of £32,988 hides the fact that most workers resident in the city actually work in low-paid, low-skilled jobs in the service economy. The Council’s State of the City Report confirms: “Manchester has the highest workplace wage among other core cities across England, but also has the lowest resident wage of all the core cities.” Although the gap has begun closing in recent years, this is in part due to the higher commuter wage declining. Further decline for both residents and commuters is likely when Manchester’s 90,100 public sector workers have their pay frozen.

The region is also extremely deprived. In 2007, Manchester came behind Liverpool, Hackney and Tower Hamlets as the fourth most deprived district in the country. 27 of the city’s 33 wards are among the most deprived tenth of wards nationally. 20 wards have child poverty rates above 79 per cent, three of which – Bradford, Harpurhey and Hulme – are at 99 per cent. Child poverty is defined by children living in families that receive Income Support, income-based Jobseeker’s Allowance, Working Families’ Tax Credit or Disabled Person’s Tax Credit. The announced cuts in benefits will almost certainly exacerbate the problem: 53,115 families in Manchester claim Child Benefits; 64,800 claim Housing Benefits; 17,350 claim Jobseeker’s Allowance and 31,200 are on Income Support. Spending cuts will have a disproportionate impact on a large proportion of the population in Greater Manchester.

Elsewhere in the budget, there is a small increase in Capital Gains Tax to 28 per cent – despite the coalition’s deal to accept the Lib Dem proposal of around 50 per cent – and a banking levy expected to bring in around £2bn. This is nothing compared to the £17-25bn expected from the VAT rise alone. It seems simply easier to extract money from the poor than it is from the rich, who also rely less on the public services already slashed or facing deeper cuts this autumn. But never mind, eh? We’re all in this together.

Tom Fox

This article features in the print edition of The Mule – Issue 10, out now for FREE around Greater Manchester

More: Manchester, Opinion

Comments

No comments found

The comments are closed.